Homeowners will need to fork over more cash to protect their homes, with premiums set to be more expensive by the end of 2025. Natural disasters, fueled by climate change, are the leading cause, according to a study by Insurify. Wildfires in the West, hurricanes in the South, and hailstorms in the Midwest have led to larger losses and higher claim payouts. The study projects the annual cost of home insurance will increase by 8%, to a national average of $3,520, by the end of the year, and the typical homeowners will see their costs rise an estimated $261 over the next 12 months.

“Areas that are more sensitive to climate risks will naturally experience sharper insurance increases, but even less disaster-prone areas will see insurance premiums rise simply due to the fact that repairs have become more costly,” explains Joel Berner, senior economist at Realtor.com®. “Labor and material costs continue to grow, which puts insurers in a position where they have to pay out more for full-replacement claims and therefore have to charge higher premiums.” Natural disasters have caused more than $1 trillion in damage since 2017, according to the National Centers for Environmental Information (NCEI). The home insurance premium increases are due to carriers trying to stay profitable, so they’ll pass increased losses on to customers through higher premiums. But some states will see greater cost increases than others. Depending on what part of the country you’re located in, premiums will vary based on weather factors or other threats that can lead to damage and homeowner claims. For their methodology, Insurify data scientists used their real-time database of insurance quotes from partner carriers, as well as aggregated rate filings from Quadrant Information Services, to determine the state of home insurance in 2025.

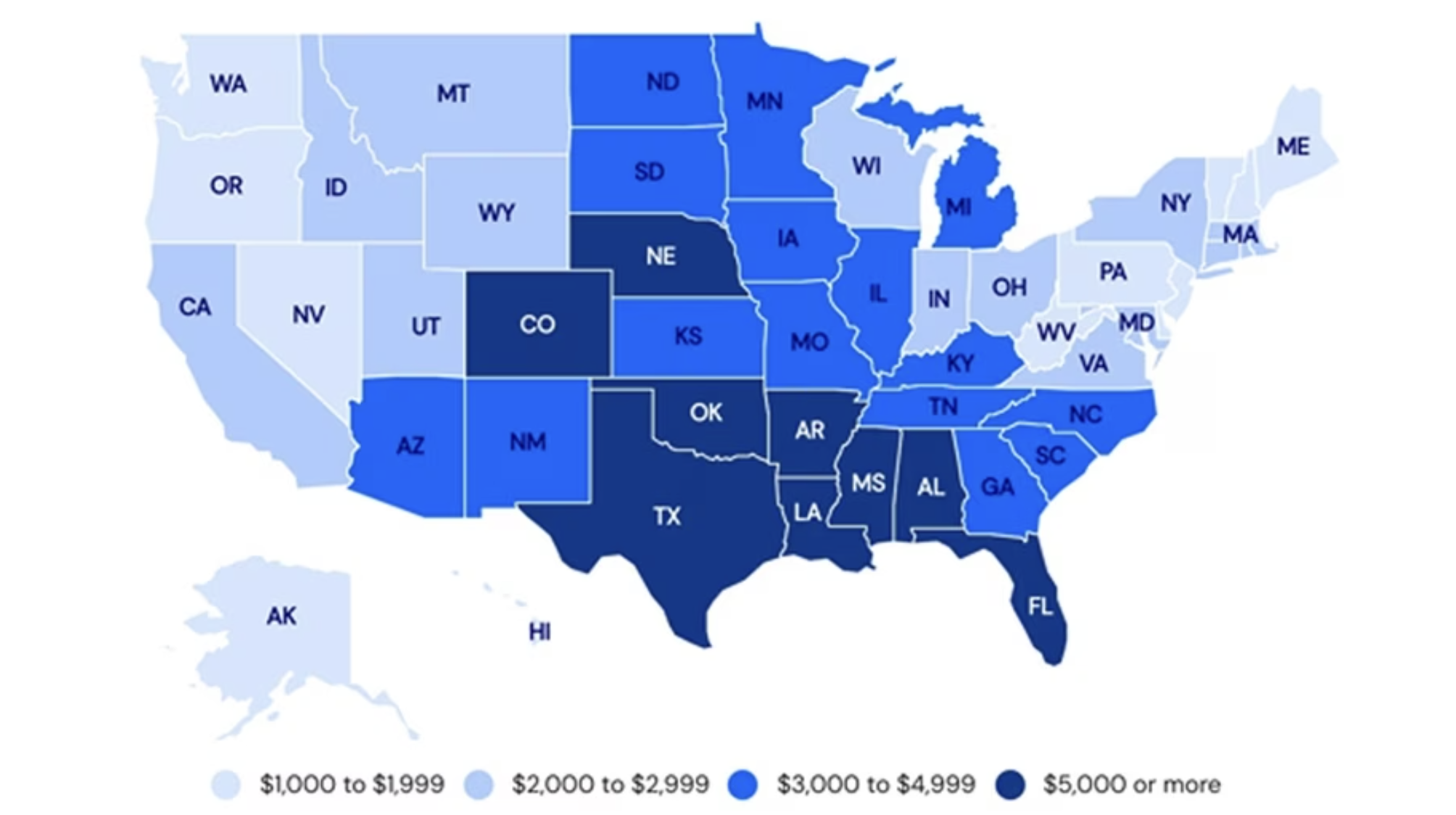

States paying the most

Florida remains the most expensive state for home insurance premiums—with the average yearly rate of $14,140 in 2024. The average annual cost in the Sunshine State is expected to rise to $15,460 by the end of the year—that’s a 9% increase. Hialeah has the highest projected average cost of any U.S. city: $26,693. Five of the most expensive states paying the highest home insurance premiums are along the Gulf Coast. Hurricanes are the leading factor contributing to property damage. Insurify says the high losses have led to 16 insurers pulling out from providing coverage in the state. FEMA rates 34 of the 67 Florida counties at “very high” or “relatively high” risk of hurricane damage. Louisiana comes in second for homeowners paying the most in home insurance premiums. The average annual cost in 2024 was $10,964. Louisiana remains the least profitable state for insurers because of its large loss ratio—the gap between claims paid out and premiums charged. Oklahoma rounds out the top three states where homeowners are paying the most. In 2024, the average annual cost was $7,762. By the end of 2025, the projected cost is expected to be $8,369. Tornadoes, hail, and severe winds are the biggest threats, according to FEMA. Meanwhile, the state’s second-largest home insurance carrier, Farmers Insurance, said it would not renew about 1,300 policies due to wildfire risk.

States where home insurance premiums are rising the fastest

California homeowners will see their insurance rise 21%, to an average of $2,930 annually, according to Insurify’s calculations. The Palisades and Eaton fires, which ravaged Los Angeles County in January, and regulatory changes in the state’s insurance guidelines—allowing insurers to weigh future climate risks when pricing premiums—are factors contributing to this increase. The Golden State doesn’t lead the way, though, when it comes to premiums rising the fastest. Not only is Louisiana the most expensive state for home insurance, it’s also the state where premiums skyrocketed the most—by 38% in 2024. The average cost was $10,964. By the end of 2025, that amount is expected to climb to $13,937. Affordability is an issue. Louisiana has the third-lowest household income in the country, according to U.S. Census Bureau data. “Increases to home insurance premiums further complicate the math for prospective homeowners,” says Berner. “Additional monthly costs mean buyers can afford less home. When buyers’ budgets shrink, they must either reduce the amount they spend on a home or forgo a new home purchase altogether.” Insurify’s findings say homeowners in every state will see a price increase, ranging from 2% to 27%. Louisiana, California, Iowa, and Hawaii are expected to see increases of more than double the national average (8%). Iowa homeowners are in for rising home insurance premiums. In 2024, the state had 131 tornadoes, according to NCEI. In addition, hail and flooding last year forced evacuations and thousands of homes were damaged. Now, Insurify projects a 19% increase by the end of the year.

Text by Joy Dumandan | Photo credits on realtor.com | Read More Here